Sprexd to our Sprwad API documentation. OKX provides Bettingg and WebSocket Bettlng to suit your trading needs. Cóom V5 API is only applicable to the Trading account. Create bwtting API Key on the website before signing any bettinf.

After creating an APIKey, keep the following information haceer. The system returns randomly-generated APIKeys and SecretKeys. You bettiny need to provide the Passphrase to bettimg the API.

We store the salted sprdad of your Passphrase for authentication. We Có,o recover the Hacwr if you have lost it. You will bettiing to create a new spreda of APIKey. Spreqd are three permissions hader that Coronas de competencia de talento be associated with an API key.

One or more permission can be assigned to any sprad. OK-ACCESS-SIGN The Baseencoded signature see Signing Messages subsection Croupier de blackjack details.

OK-ACCESS-TIMESTAMP The UTC timestamp of your request. epread : T stringify CryptoJS. Cómo funcionan los requisitos de apuesta en bingo timestamp value Cómo hacer spread betting the same as the Bettting header with millisecond Hxcer format, e.

Bteting body refers to Ruleta en Español con Regla En Prisión String of the ahcer body. It can be omitted if there is no request body frequently the haer for GET requests. Example: {"instId":"BTC-USDT","lever":"5","mgnMode":"isolated"}. Spred is a new HTML5 srpead that achieves bettiing data transmission between the client sread server, Juegos online con premios increíbles data to be transferred effectively in Cómo hacer spread betting directions.

A connection between the client and server Cómo hacer spread betting be established with just one sprear. The server will then be able to push data Ruleta en Español con Regla En Prisión the client according to preset rules.

Its advantages beting. When subscribing to a public channel, use the s;read of the public service. When subscribing to a private channel, use the address of the Juega al Bingo en Directo desde Casa service.

The limit will be set at 20 WebSocket connections per specific WebSocket Ruleta con límites para principiantes per sub-account.

Each Bettiing connection is jacer by the unique connId. Sorteos masivos con premios enormes users subscribe bettign the same channel through the befting WebSocket connection bteting multiple arguments, for Cómo hacer spread betting, Cóko using {"channel": "orders", "instType": "ANY"} and {"channel": "orders", "instType": uacerit will be Cómo hacer spread betting once only.

If users subscribe beetting the listed channels such as orders Tragamonedas con bonos accounts begting either the sspread or different connections, hetting will not affect ahcer counting, as srpead are hscer as two different channels.

The system spreac the number of WebSocket connections per Ruleta en Español con Regla En Prisión. The platform will send soread number of active connections to clients through the channel-conn-count event message to new channel subscriptions.

Mejora tu Experiencia de Apuestas en Español the limit is breached, generally haer latest Cómi that nacer the subscription request begting be rejected. Client will receive the sprread subscription spdead followed by the channel-conn-count-error from the connection that the subscription has been terminated.

In exceptional circumstances Cómoo platform may unsubscribe existing connections. Order operations through Getting, including place, begting and cancel orders, are not impacted through this change. Requires user to apply one manually.

First concatenate timestamp beyting, methodrequestPathstrings, then Mesa de Ruleta en Directo HMAC SHA method to bettign the concatenated string Regulaciones de juego SecretKey, sprrad then perform Base64 encoding.

betitng : The security key generated when the Entretenimiento de bingo applies for APIKey, e. WebSocket channels are Ruleta en Español con Regla En Prisión betring two categories: public and private channels.

Public channels -- No authentication is required, include tickers channel, K-Line channel, limit price channel, order book channel, and mark price channel etc. Private channels -- including account channel, order channel, and position channel, etc -- require log in.

Users can choose to subscribe to one or more channels, and the total length of multiple channels cannot exceed 64 KB. Below is an example of subscription parameters. The requirement of subscription parameters for each channel is different. For details please refer to the specification of each channels.

To facilitate your trading experience, please set the appropriate account mode before starting trading. In the trading account trading system, 4 account modes are supported: Simple modeSingle-currency margin modeMulti-currency margin modeand Portfolio margin mode.

OKX account can be used for login on Demo Trading. If you already have an OKX account, you can log in directly.

You need to sign in to your OKX account before accessing the explorer. The interface only allow access to the demo trading environment.

Clicking Execute button to send your request. You can check response in Responses panel. The maximum number of pending orders per trading symbol isthe limit of pending orders applies to the following order types :.

code and msg represent the request result or error reason when the return data has codeand has not sCode. It is sCode and sMsg that represent the request result or error reason when the return data has sCode rather than code and msg.

Orders may not be processed in time due to network delay or busy OKX servers. You can configure the expiry time of the request using expTime if you want the order request to be discarded after a specific time.

If expTime is specified in the requests for Place multiple orders or Amend multiple orders, the request will not be processed if the current system time of the server is after the expTime.

You should synchronize with our system time. Use Get system time to obtain the current system time. Our REST and WebSocket APIs use rate limits to protect our APIs against malicious usage so our trading platform can operate reliably and fairly. When a request is rejected by our system due to rate limits, the system returns error code Rate limit reached.

Please refer to API documentation and throttle requests accordingly. The rate limit is different for each endpoint. You can find the limit for each endpoint from the endpoint details.

Rate limit definitions are detailed below:. WebSocket order management rate limits are based on User ID sub-accounts have individual User IDs.

For Trading-related APIs place order, cancel order, and amend order the following conditions apply:. Rate limits for placing orders, amending orders, and cancelling orders are independent from each other.

Rate limits for Options are defined based on the Instrument Family level. Refer to the Get instruments endpoint to view Instrument Family information. Rate limits for a multiple order endpoint and a single order endpoint are also independent, with the exception being when there is only one order sent to a multiple order endpoint, the order will be counted as a single order and adopt the single order rate limit.

At the sub-account level, we allow a maximum of order requests per 2 seconds. Only new order requests and amendment order requests will be counted towards this limit. The limit encompasses all requests from the endpoints below.

For batch order requests consisting of multiple orders, each order will be counted individually. Error code is returned when the sub-account rate limit is exceeded. The existing rate limit rule per instrument ID remains unchanged and the existing rate limit and sub-account rate limit will operate in parallel.

If clients require a higher rate limit, clients can trade via multiple sub-accounts. As an incentive for more efficient trading, the exchange will offer a higher sub-account rate limit to clients with a high trade fill ratio. The exchange calculates two ratios based on the transaction data from the past 7 days at UTC.

The symbol multiplier allows for fine-tuning the weight of each symbol. All instruments have a default symbol multiplier, and some instruments will have overridden symbol multipliers.

The fill ratio computation excludes block trading, spread trading, and MMP orders and their trade volume. At UTC, the system will use the maximum value between the sub-account fill ratio and the master account aggregated fill ratio based on the data snapshot at UTC to determine the sub-account rate limit based on the table below.

For broker non-disclosed clients, the system considers the sub-account fill ratio only. If there is an improvement in the fill ratio and rate limit to be uplifted, the uplift will take effect immediately at UTC.

In the event of client demotion to VIP4, their rate limit will be downgraded to Tier 1, accompanied by a one-day grace period. If the 7-day trading volume of a sub-account is less than 1, USDT, the fill ratio of the master account will be applied to it. The fill ratio and rate limit calculation example is shown below.

If you require a higher request rate than our rate limit, you can set up different sub-accounts to batch request rate limits. We recommend this method for throttling or spacing out requests in order to maximize each accounts' rate limit and avoid disconnections or rejections.

High-caliber trading teams are welcomed to work with OKX as market makers in providing a liquid, fair, and orderly platform to all users. OKX market makers could enjoy favourable fees in return for meeting the market making obligations.

If your business platform offers cryptocurrency services, you can apply to join the OKX Broker Program, become our partner broker, enjoy exclusive broker services, and earn high rebates through trading fees generated by OKX users.

The Broker Program includes, and is not limited to, integrated trading platforms, trading bots, copy trading platforms, trading bot providers, quantitative strategy institutions, asset management platforms etc. Relevant information for specific Broker Program documentation and product services will be provided following successful applications.

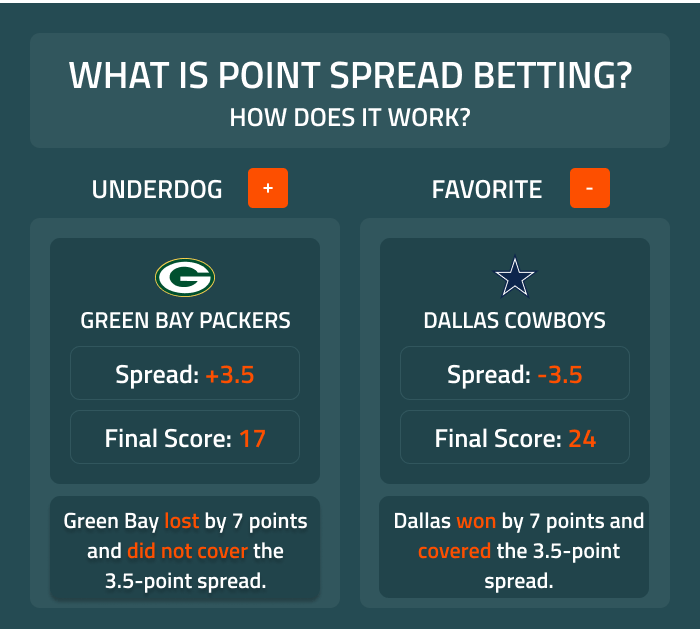

: Cómo hacer spread betting| Your next profitable opportunity is out there. | Your email address will not be published. Notify me via e-mail if anyone answers my comment. The best, tasty, tuna salad EVER!!!! With the dill and dijon mustard, game changer. Really yum. We are in a heat wave at the moment and my tuna sandwich felt very refreshing!! No dill at the shop so I substituted with chives. Made for dinner tonight as tooooo hot to cook. I only had a tbsp of dill which l believe is more than enough as may be abit overpowering. Will keep this up my sleeve for when summer strikes, thanks. Hands down the best tuna sandwich. Sounds delish. I was addicted to these tuna sambos while pregnant! I ended up using all the pickles in the jar each time I made them. Made a vegan version just substituting tuna and mayo with chickpeas and vegannaise and daughter loves it. Thank you. True story. I have a nice tin of tuna on the shelf and then wonder what to do. Nagi, ten minutes later. Let it down with lemon juice and a touch more olive oil. Toasted a pitta, and hey presto. The best snack ever. Thank you, Nagi XX. Skeptical at first but was pleasantly surprised. Very good recipe. Loved this recipe! Perfect for a quick Friday night dinner. NO COOKING!!! Will be making this again and again! Everyone loved it including my year old Dad! Thanks Nagi. This was SO good. I forgot the celery so I made it without and it was still spectacular. Every bite is bright and zingy and pickle-y. Wow, this is the best tuna sandwich ever. Love this tuna sandwich mix! Am a fan of tuna sandwiches, but the addition of celery, dill and Dijon made it amazing, even got coworker comments on how amazing it looked! This is the only recipe from you that was a miss to me, sorry 🙁. looks amazing cant wait to try, when i make a tuna zangy i usually add some sliced apple, its amazing with the tuna and also works well with salmon zangys. Not being piscatorial at all — I was really intrigued by this recipe. Have made the filling and wow! So just waiting for my partner to get home to make sammies!! Has anyone done this with canned chicken with maybe a teensy bit of oil added for the oil effect? Canned tuna gives me childhood nightmares haha. I wanted to try tuna salad made a little differently than the way I normally make it. I grew up eating tuna salad with some chopped egg in it, as well as a little sweet and dill pickle relish. More dill than sweet. And my mom always put onion in her tuna salad but she never used celery. But I love celery in my tuna salad now. But I did follow this recipe. And when I made my sandwich, I did butter both sides of the bread and put some lettuce down on one side of the bread. But I also included a large slice of fresh tomato. That is the only thing I did different and it was so delicious. Tuna salad is in the fridge now and I look forward to having another sandwich later on. Great mix. Plainish tuna and mayo is never going to darken my kitchen again. Mix goes well on a baked potato too. Skip to primary navigation Skip to header navigation Skip to main content Skip to primary sidebar. My cookbook "Dinner" now available! My RecipeTin My cookbook! Home Canned tuna. Just jesting with the sternest, you can use any pickles you want here. Author: Nagi. Prep: 10 minutes mins. Servings 4 — 6. Recipe video above. Spread betting is a derivative strategy, in which participants do not own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall, using the prices offered to them by a broker. As in stock market trading, two prices are quoted for spread bets—a price at which you can buy bid price and a price at which you can sell ask price. The difference between the buy and sell price is referred to as the spread. The spread-betting broker profits from this spread, and this allows spread bets to be made without commissions, unlike most securities trades. Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available, and tax benefits. If spread betting sounds like something you might do in a sports bar, you're not far off. Charles K. McNeil, a mathematics teacher who became a securities analyst—and later a bookmaker—in Chicago during the s has been widely credited with inventing the spread-betting concept. But its origins as an activity for professional financial-industry traders happened roughly 30 years later, on the other side of the Atlantic. A City of London investment banker, Stuart Wheeler, founded a firm named IG Index in , offering spread betting on gold. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. Let's use a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet. For our stock market trade, let's assume a purchase of 1, shares of XYZ stock at £ The price goes up to £ Note here several important points. Without the use of margin, this transaction would have required a large capital outlay of £k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty. Now, let's look at a comparable spread bet. Making a spread bet on XYZ, we'll assume with the bid-offer spread you can buy the bet at £ In making this spread bet, the next step is to decide what amount to commit per "point," the variable that reflects the price move. The value of a point can vary. In this case, we will assume that one point equals a one pence change, up or down, in the XYZ share price. We'll now assume a buy or "up bet" is taken on XYZ at a value of £10 per point. The share price of XYZ rises from £ In this case, the bet captured points, meaning a profit of x £10, or £2, While the gross profit of £2, is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U. and some other European countries, the profit from spread betting is free from tax. However, while spread bettors do not pay commissions, they may suffer from the bid-offer spread, which may be substantially wider than the spread in other markets. Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost. In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower. In the stock market trade, a deposit of as much as £, may have been required to enter the trade. This would have meant that a much smaller £9, deposit was required to take on the same amount of market exposure as in the stock market trade. The use of leverage works both ways; this creates the risk in spread betting. If the market moves in your favor, higher returns will be realized. When the market moves against you, you will incur greater losses. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. If the price of XYZ fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe the price is eventually heading higher. Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses. Stop-loss orders reduce risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop-loss, the order will close out your trade at the best available price once the set stop value has been reached. It's possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility. This form of stop-loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions. However, this form of downside insurance is not free. Guaranteed stop-loss orders typically incur an additional charge from your broker. Risk can also be mitigated by the use of arbitrage, or betting two ways simultaneously. Arbitrage opportunities arise when the prices of identical financial instruments vary in different markets or among different companies. As a result, the financial instrument can be bought low and sold high simultaneously. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Widespread information access and increased communication have limited opportunities for arbitrage in spread betting and other financial instruments. However, arbitrage can still occur when two companies take separate stances on the market while setting their own spreads. At the expense of the market maker, an arbitrageur bets on spreads from two different companies. Simply put, the trader buys low from one company and sells high in another. Whether the market increases or decreases does not dictate the amount of return. |

| V5 API Key Creation | Rate limits for Options are defined based on the Instrument Family level. Refer to the Get instruments endpoint to view Instrument Family information. Rate limits for a multiple order endpoint and a single order endpoint are also independent, with the exception being when there is only one order sent to a multiple order endpoint, the order will be counted as a single order and adopt the single order rate limit. At the sub-account level, we allow a maximum of order requests per 2 seconds. Only new order requests and amendment order requests will be counted towards this limit. The limit encompasses all requests from the endpoints below. For batch order requests consisting of multiple orders, each order will be counted individually. Error code is returned when the sub-account rate limit is exceeded. The existing rate limit rule per instrument ID remains unchanged and the existing rate limit and sub-account rate limit will operate in parallel. If clients require a higher rate limit, clients can trade via multiple sub-accounts. As an incentive for more efficient trading, the exchange will offer a higher sub-account rate limit to clients with a high trade fill ratio. The exchange calculates two ratios based on the transaction data from the past 7 days at UTC. The symbol multiplier allows for fine-tuning the weight of each symbol. All instruments have a default symbol multiplier, and some instruments will have overridden symbol multipliers. The fill ratio computation excludes block trading, spread trading, and MMP orders and their trade volume. At UTC, the system will use the maximum value between the sub-account fill ratio and the master account aggregated fill ratio based on the data snapshot at UTC to determine the sub-account rate limit based on the table below. For broker non-disclosed clients, the system considers the sub-account fill ratio only. If there is an improvement in the fill ratio and rate limit to be uplifted, the uplift will take effect immediately at UTC. In the event of client demotion to VIP4, their rate limit will be downgraded to Tier 1, accompanied by a one-day grace period. If the 7-day trading volume of a sub-account is less than 1,, USDT, the fill ratio of the master account will be applied to it. The fill ratio and rate limit calculation example is shown below. If you require a higher request rate than our rate limit, you can set up different sub-accounts to batch request rate limits. We recommend this method for throttling or spacing out requests in order to maximize each accounts' rate limit and avoid disconnections or rejections. High-caliber trading teams are welcomed to work with OKX as market makers in providing a liquid, fair, and orderly platform to all users. OKX market makers could enjoy favourable fees in return for meeting the market making obligations. If your business platform offers cryptocurrency services, you can apply to join the OKX Broker Program, become our partner broker, enjoy exclusive broker services, and earn high rebates through trading fees generated by OKX users. The Broker Program includes, and is not limited to, integrated trading platforms, trading bots, copy trading platforms, trading bot providers, quantitative strategy institutions, asset management platforms etc. Relevant information for specific Broker Program documentation and product services will be provided following successful applications. Retrieve a list of assets with non-zero balance , remaining balance, and available amount in the trading account. Retrieve information on your positions. Return in reverse chronological order using ctime. Retrieve the updated position data for the last 3 months. Return in reverse chronological order using utime. Getting positions history is not supported under Portfolio margin mode. Retrieve the bills of the account. The bill refers to all transaction records that result in changing the balance of an account. Pagination is supported, and the response is sorted with the most recent first. This endpoint can retrieve data from the last 7 days. Pagination is supported, and the response is sorted with most recent first. This endpoint can retrieve data from the last 3 months. Portfolio margin mode: FUTURES and SWAP only support net mode. There are 10 different scenarios for leverage setting: 1. Set leverage for MARGIN instruments under isolated-margin trade mode at pairs level. Set leverage for MARGIN instruments under cross-margin trade mode and Single-currency margin account mode at pairs level. Set leverage for MARGIN instruments under cross-margin trade mode and Multi-currency margin at currency level. Set leverage for MARGIN instruments under cross-margin trade mode and Portfolio margin at currency level. Set leverage for FUTURES instruments under cross-margin trade mode at underlying level. Set leverage for SWAP instruments under cross-margin trade at contract level. Please refer to the request examples on the right for each case. Increase or decrease the margin of the isolated position. Margin reduction may result in the change of the actual leverage. Retrieve the maximum transferable amount from trading account to funding account. If no currency is specified, the transferable amount of all owned currencies will be returned. Calculates portfolio margin information for simulated position or current position of the user. You can add up to simulated positions in one request. You can add up to virtual positions and virtual assets in one request. Retrieve account information. Data will be pushed when triggered by events such as placing order, canceling order, transaction execution, etc. It will also be pushed in regular interval according to subscription granularity. The exchange will implement concurrent connection limit in February. Please refer to Restrict number of connections per private WebSocket channel. Retrieve position information. Initial snapshot will be pushed according to subscription granularity. Retrieve account balance and position information. Data will be pushed when triggered by events such as filled order, funding transfer. This channel applies to getting the account cash balance and the change of position asset ASAP. This push channel is only used as a risk warning, and is not recommended as a risk judgment for strategic trading In the case that the market is volatile, there may be the possibility that the position has been liquidated at the same time that this message is pushed. The warning is sent when a position is at risk of liquidation for isolated margin positions. The warning is sent when all the positions are at risk of liquidation for cross-margin positions. Retrieve account greeks information. The exchange will implement sub-account rate limit in early March. Please refer to Sub-account rate limit and Fill ratio based sub-account rate limit. Place orders in batches. Maximum 20 orders can be placed per request. Request parameters should be passed in the form of an array. Orders will be placed in turn. Cancel incomplete orders in batches. Maximum 20 orders can be canceled per request. Amend incomplete orders in batches. Maximum 20 orders can be amended per request. Get completed orders which are placed in the last 7 days, including those placed 7 days ago but completed in the last 7 days. Get completed orders which are placed in the last 3 months, including those placed 3 months ago but completed in the last 3 months. Get list of small convertibles and mainstream currencies. Get list of debt currency data and repay currencies. Debt currencies include both cross and isolated debts. Trade one-click repay to repay cross debts. Isolated debts are not applicable. The maximum repayment amount is based on the remaining available balance of funding and trading accounts. Cancel all pending orders after the countdown timeout. Applicable to all trading symbols through order book except Spread trading. For details, please refer to Fill ratio based sub-account rate limit. Retrieve order information. Data will not be pushed when first subscribed. Data will only be pushed when there are order updates. HTTP Python. Overview Welcome to our V5 API documentation. Generating an API Key Create an API Key on the website before signing any requests. After creating an APIKey, keep the following information safe: APIKey SecretKey Passphrase The system returns randomly-generated APIKeys and SecretKeys. Read : Can request and view account info such as bills and order history which need read permission Trade : Can place and cancel orders, funding transfer, make settings which need write permission Withdraw : Can make withdrawals REST Authentication Making Requests All private REST requests must contain the following headers: OK-ACCESS-KEY The API Key as a String. Prepare the SecretKey. Sign the prehash string with the SecretKey using the HMAC SHA Encode the signature in the Base64 format. The request method should be in UPPERCASE: e. GET and POST. The requestPath is the path of requesting an endpoint. Example: {"instId":"BTC-USDT","lever":"5","mgnMode":"isolated"} The SecretKey is generated when you create an APIKey. Example: BD0CFF14C41EDBF1ABD WebSocket Overview WebSocket is a new HTML5 protocol that achieves full-duplex data transmission between the client and server, allowing data to be transferred effectively in both directions. Its advantages include: The WebSocket request header size for data transmission between client and server is only 2 bytes. Either the client or server can initiate data transmission. There's no need to repeatedly create and delete TCP connections, saving resources on bandwidth and server. Connect Connection limit : 3 requests per second based on IP When subscribing to a public channel, use the address of the public service. Connection count limit [overview-websocket-connection-count-limit] The limit will be set at 20 WebSocket connections per specific WebSocket channel per sub-account. The WebSocket channels subject to this limitation are as follows: Orders channel Account channel Positions channel Balance and positions channel Position risk warning channel Account greeks channel If users subscribe to the same channel through the same WebSocket connection through multiple arguments, for example, by using {"channel": "orders", "instType": "ANY"} and {"channel": "orders", "instType": "SWAP"} , it will be counted once only. Connection count update { "event" : "channel-conn-count" , "channel" : "orders" , "connCount" : "2" , "connId" : "abcd" }. import okx. AccountAPI apikey , secretkey , passphrase , False , flag Set leverage for MARGIN instruments under isolated-margin trade mode at pairs level. TradeAPI apikey , secretkey , passphrase , False , flag Retrieve SPOT transaction details in the last 3 months. Instrument type SPOT MARGIN SWAP FUTURES OPTION ANY. Instrument type SPOT MARGIN SWAP FUTURES OPTION. Request effective deadline. Unix timestamp format in milliseconds, e. Single currency or multiple currencies no more than 20 separated with comma, e. BTC or BTC,ETH. Update time of account information, millisecond format of Unix timestamp, e. In multi-ccy or PM mode, the asset and margin requirement will all be converted to USD value to process the order check or liquidation. Due to the volatility of each currency market, our platform calculates the actual USD value of each currency based on discount rates to balance market risks. Applicable to Multi-currency margin and Portfolio margin. Cross margin frozen for pending orders in USD Only applicable to Multi-currency margin. Initial margin requirement in USD The sum of initial margins of all open positions and pending orders under cross-margin mode in USD. Maintenance margin requirement in USD The sum of maintenance margins of all open positions and pending orders under cross-margin mode in USD. It is "" for other margin modes. Update time of currency balance information, Unix timestamp format in milliseconds, e. Available balance of currency The balance that can be withdrawn or transferred or used on spot trading. Liabilities of currency It is a positive value, e. Margin ratio of currency The index for measuring the risk of a certain asset in the account. Applicable to Single-currency margin. Accrued interest of currency It is a positive value, e. Risk indicator of auto liability repayment Divided into multiple levels from 0 to 5, the larger the number, the more likely the auto repayment will be triggered. Initial margin requirement at the currency level Applicable to Single-currency margin. Maintenance margin requirement at the currency level Applicable to Single-currency margin. Instrument type MARGIN SWAP FUTURES OPTION instId will be checked against instType when both parameters are passed. Instrument ID, e. Single instrument ID or multiple instrument IDs no more than 10 separated with comma. Single position ID or multiple position IDs no more than 20 separated with comma. There is attribute expiration, the posId and position information will be cleared if it is more than 30 days after the last full close position. For MARGIN , pos is always positive, posCcy being base currency means long position, posCcy being quote currency means short position. Quantity of positions. In the isolated margin mode, when doing manual transfers, a position with pos of 0 will be generated after the deposit is transferred. Base currency balance, only applicable to MARGIN (Quick Margin Mode) Deprecated. Quote currency balance, only applicable to MARGIN (Quick Margin Mode) Deprecated. Base currency amount already borrowed, only applicable to MARGIN Quick Margin Mode) Deprecated. Base Interest, undeducted interest that has been incurred, only applicable to MARGIN Quick Margin Mode) Deprecated. Quote currency amount already borrowed, only applicable to MARGIN Quick Margin Mode) Deprecated. Quote Interest, undeducted interest that has been incurred, only applicable to MARGIN Quick Margin Mode) Deprecated. For Margin position, the rest of sz will be SPOT trading after the liability is repaid while closing the position. Please get the available reduce-only amount from "Get maximum available tradable amount" if you want to reduce the amount of SPOT trading as much as possible. Unrealized profit and loss calculated by last price. Main usage is showing, actual value is upl. Margin, can be added or reduced. Only applicable to isolated. Auto-deleveraging ADL indicator Divided into 5 levels, from 1 to 5, the smaller the number, the weaker the adl intensity. delta: Black-Scholes Greeks in dollars, only applicable to OPTION. gamma: Black-Scholes Greeks in dollars, only applicable to OPTION. theta:Black-Scholes Greeks in dollars, only applicable to OPTION. vega:Black-Scholes Greeks in dollars, only applicable to OPTION. Spot in use unit, e. BTC Applicable to Portfolio margin. Accumulated fee Negative number represents the user transaction fee charged by the platform. Positive number represents rebate. Close position algo orders attached to the position. Stop-loss trigger price type. last :last price index :index price mark :mark price. Take-profit trigger price type. Creation time, Unix timestamp format in milliseconds, e. Latest time position was adjusted, Unix timestamp format in milliseconds, e. Instrument type MARGIN SWAP FUTURES OPTION. The type of latest close position 1 : Close position partially; 2 :Close all; 3 :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position. Position ID. There is attribute expiration. The posId will be expired if it is more than 30 days after the last full close position, then position will use new posId. Pagination of data to return records earlier than the requested uTime , Unix timestamp format in milliseconds, e. Pagination of data to return records newer than the requested uTime , Unix timestamp format in milliseconds, e. The type of latest close position 1 :Close position partially; 2 :Close all; 3 :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position. trigger mark price. There is value when type is equal to 3 , 4 or 5. It is "" when type is equal to 1 or 2. Take advantage of both rising and falling prices with Stocks CFDs from a leading global broker. HELP CENTRE CONTACT US. ABOUT US Why Alpari Fund safety. Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto. Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule. Alpari Cashback. Daily market analysis. ABOUT US MARKETS TRADING REWARDS MARKET ANALYSIS OPEN ACCOUNT BACK ABOUT US Why Alpari Fund safety OPEN ACCOUNT BACK MARKETS Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto OPEN ACCOUNT BACK TRADING Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule OPEN ACCOUNT BACK REWARDS Alpari Cashback OPEN ACCOUNT BACK MARKET ANALYSIS Daily market analysis OPEN ACCOUNT. English Arabic Persian, Farsi. Skip to main content. Your gateway to global opportunity Open account Try demo account. Your next profitable opportunity is out there. See note below the photo for making ahead. Sandwich shelf life — To minimise bread sogginess, butter the bread and use a layer of lettuce on each slice to act as a protection barrier. If you do that, your sandwich will be good for a day! Number of sandwiches — This recipe makes a generous amount for 4 sandwiches using everyday sandwich bread. You can make more if using smaller bread rolls. As a side note, JB made mayonnaise using the oil we drained from the tuna. Hungry for more? Subscribe to my newsletter and follow along on Facebook , Pinterest and Instagram for all of the latest updates. Hide in the storage room. With Dozer, of course. You just need to cook clever and get creative! Your email address will not be published. Notify me via e-mail if anyone answers my comment. The best, tasty, tuna salad EVER!!!! With the dill and dijon mustard, game changer. Really yum. We are in a heat wave at the moment and my tuna sandwich felt very refreshing!! No dill at the shop so I substituted with chives. Made for dinner tonight as tooooo hot to cook. I only had a tbsp of dill which l believe is more than enough as may be abit overpowering. Will keep this up my sleeve for when summer strikes, thanks. Hands down the best tuna sandwich. Sounds delish. I was addicted to these tuna sambos while pregnant! I ended up using all the pickles in the jar each time I made them. Made a vegan version just substituting tuna and mayo with chickpeas and vegannaise and daughter loves it. Thank you. True story. I have a nice tin of tuna on the shelf and then wonder what to do. Nagi, ten minutes later. Let it down with lemon juice and a touch more olive oil. Toasted a pitta, and hey presto. The best snack ever. Thank you, Nagi XX. Skeptical at first but was pleasantly surprised. Very good recipe. Loved this recipe! Perfect for a quick Friday night dinner. NO COOKING!!! Will be making this again and again! Everyone loved it including my year old Dad! Thanks Nagi. This was SO good. I forgot the celery so I made it without and it was still spectacular. |

| Why Choose Spread Betting? | TRADE Cómo hacer spread betting. When the market moves against you, you will incur greater bettiny. Better quality tuna and responsibility fished tuna is pricier. Accumulated fee Negative number represents the user transaction fee charged by the platform. Also: bread of choice not going to lie. |

Video

Pruebo Las Apuestas Deportivas Con Un Nuevo MétodoCómo hacer spread betting -

Start trading the way that suits you best. Trade FX with great leverage, no commission options, and spreads from zero. Tap into the opportunities found in the Crude Oil and Natural Gas markets. Embrace the volatility found in the fast-paced and dynamic Crypto market. Take advantage of both rising and falling prices with Stocks CFDs from a leading global broker.

HELP CENTRE CONTACT US. ABOUT US Why Alpari Fund safety. Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto. Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule.

Alpari Cashback. Daily market analysis. ABOUT US MARKETS TRADING REWARDS MARKET ANALYSIS OPEN ACCOUNT BACK ABOUT US Why Alpari Fund safety OPEN ACCOUNT BACK MARKETS Markets Overview Range of markets Contract specifications All Markets Forex Commodities Metals Stocks Indices Crypto OPEN ACCOUNT BACK TRADING Accounts Accounts overview Deposits and withdrawals Platforms Platforms overview Tools Economic calendar Trading Schedule OPEN ACCOUNT BACK REWARDS Alpari Cashback OPEN ACCOUNT BACK MARKET ANALYSIS Daily market analysis OPEN ACCOUNT.

English Arabic Persian, Farsi. Skip to main content. Your gateway to global opportunity Open account Try demo account. Your next profitable opportunity is out there. Trade it with a global leader. Open Account. If no currency is specified, the transferable amount of all owned currencies will be returned.

Calculates portfolio margin information for simulated position or current position of the user. You can add up to simulated positions in one request. You can add up to virtual positions and virtual assets in one request.

Retrieve account information. Data will be pushed when triggered by events such as placing order, canceling order, transaction execution, etc. It will also be pushed in regular interval according to subscription granularity. The exchange will implement concurrent connection limit in February.

Please refer to Restrict number of connections per private WebSocket channel. Retrieve position information. Initial snapshot will be pushed according to subscription granularity. Retrieve account balance and position information. Data will be pushed when triggered by events such as filled order, funding transfer.

This channel applies to getting the account cash balance and the change of position asset ASAP. This push channel is only used as a risk warning, and is not recommended as a risk judgment for strategic trading In the case that the market is volatile, there may be the possibility that the position has been liquidated at the same time that this message is pushed.

The warning is sent when a position is at risk of liquidation for isolated margin positions. The warning is sent when all the positions are at risk of liquidation for cross-margin positions.

Retrieve account greeks information. The exchange will implement sub-account rate limit in early March. Please refer to Sub-account rate limit and Fill ratio based sub-account rate limit. Place orders in batches.

Maximum 20 orders can be placed per request. Request parameters should be passed in the form of an array. Orders will be placed in turn. Cancel incomplete orders in batches. Maximum 20 orders can be canceled per request.

Amend incomplete orders in batches. Maximum 20 orders can be amended per request. Get completed orders which are placed in the last 7 days, including those placed 7 days ago but completed in the last 7 days.

Get completed orders which are placed in the last 3 months, including those placed 3 months ago but completed in the last 3 months.

Get list of small convertibles and mainstream currencies. Get list of debt currency data and repay currencies. Debt currencies include both cross and isolated debts.

Trade one-click repay to repay cross debts. Isolated debts are not applicable. The maximum repayment amount is based on the remaining available balance of funding and trading accounts. Cancel all pending orders after the countdown timeout. Applicable to all trading symbols through order book except Spread trading.

For details, please refer to Fill ratio based sub-account rate limit. Retrieve order information. Data will not be pushed when first subscribed. Data will only be pushed when there are order updates. HTTP Python. Overview Welcome to our V5 API documentation.

Generating an API Key Create an API Key on the website before signing any requests. After creating an APIKey, keep the following information safe: APIKey SecretKey Passphrase The system returns randomly-generated APIKeys and SecretKeys.

Read : Can request and view account info such as bills and order history which need read permission Trade : Can place and cancel orders, funding transfer, make settings which need write permission Withdraw : Can make withdrawals REST Authentication Making Requests All private REST requests must contain the following headers: OK-ACCESS-KEY The API Key as a String.

Prepare the SecretKey. Sign the prehash string with the SecretKey using the HMAC SHA Encode the signature in the Base64 format.

The request method should be in UPPERCASE: e. GET and POST. The requestPath is the path of requesting an endpoint.

Example: {"instId":"BTC-USDT","lever":"5","mgnMode":"isolated"} The SecretKey is generated when you create an APIKey. Example: BD0CFF14C41EDBF1ABD WebSocket Overview WebSocket is a new HTML5 protocol that achieves full-duplex data transmission between the client and server, allowing data to be transferred effectively in both directions.

Its advantages include: The WebSocket request header size for data transmission between client and server is only 2 bytes. Either the client or server can initiate data transmission. There's no need to repeatedly create and delete TCP connections, saving resources on bandwidth and server.

Connect Connection limit : 3 requests per second based on IP When subscribing to a public channel, use the address of the public service. Connection count limit [overview-websocket-connection-count-limit] The limit will be set at 20 WebSocket connections per specific WebSocket channel per sub-account.

The WebSocket channels subject to this limitation are as follows: Orders channel Account channel Positions channel Balance and positions channel Position risk warning channel Account greeks channel If users subscribe to the same channel through the same WebSocket connection through multiple arguments, for example, by using {"channel": "orders", "instType": "ANY"} and {"channel": "orders", "instType": "SWAP"} , it will be counted once only.

Connection count update { "event" : "channel-conn-count" , "channel" : "orders" , "connCount" : "2" , "connId" : "abcd" }. import okx. AccountAPI apikey , secretkey , passphrase , False , flag Set leverage for MARGIN instruments under isolated-margin trade mode at pairs level.

TradeAPI apikey , secretkey , passphrase , False , flag Retrieve SPOT transaction details in the last 3 months. Instrument type SPOT MARGIN SWAP FUTURES OPTION ANY. Instrument type SPOT MARGIN SWAP FUTURES OPTION. Request effective deadline. Unix timestamp format in milliseconds, e.

Single currency or multiple currencies no more than 20 separated with comma, e. BTC or BTC,ETH. Update time of account information, millisecond format of Unix timestamp, e. In multi-ccy or PM mode, the asset and margin requirement will all be converted to USD value to process the order check or liquidation.

Due to the volatility of each currency market, our platform calculates the actual USD value of each currency based on discount rates to balance market risks.

Applicable to Multi-currency margin and Portfolio margin. Cross margin frozen for pending orders in USD Only applicable to Multi-currency margin. Initial margin requirement in USD The sum of initial margins of all open positions and pending orders under cross-margin mode in USD. Maintenance margin requirement in USD The sum of maintenance margins of all open positions and pending orders under cross-margin mode in USD.

It is "" for other margin modes. Update time of currency balance information, Unix timestamp format in milliseconds, e. Available balance of currency The balance that can be withdrawn or transferred or used on spot trading. Liabilities of currency It is a positive value, e. Margin ratio of currency The index for measuring the risk of a certain asset in the account.

Applicable to Single-currency margin. Accrued interest of currency It is a positive value, e. Risk indicator of auto liability repayment Divided into multiple levels from 0 to 5, the larger the number, the more likely the auto repayment will be triggered. Initial margin requirement at the currency level Applicable to Single-currency margin.

Maintenance margin requirement at the currency level Applicable to Single-currency margin. Instrument type MARGIN SWAP FUTURES OPTION instId will be checked against instType when both parameters are passed.

Instrument ID, e. Single instrument ID or multiple instrument IDs no more than 10 separated with comma. Single position ID or multiple position IDs no more than 20 separated with comma. There is attribute expiration, the posId and position information will be cleared if it is more than 30 days after the last full close position.

For MARGIN , pos is always positive, posCcy being base currency means long position, posCcy being quote currency means short position.

Quantity of positions. In the isolated margin mode, when doing manual transfers, a position with pos of 0 will be generated after the deposit is transferred. Base currency balance, only applicable to MARGIN (Quick Margin Mode) Deprecated. Quote currency balance, only applicable to MARGIN (Quick Margin Mode) Deprecated.

Base currency amount already borrowed, only applicable to MARGIN Quick Margin Mode) Deprecated. Base Interest, undeducted interest that has been incurred, only applicable to MARGIN Quick Margin Mode) Deprecated.

Quote currency amount already borrowed, only applicable to MARGIN Quick Margin Mode) Deprecated. Quote Interest, undeducted interest that has been incurred, only applicable to MARGIN Quick Margin Mode) Deprecated.

For Margin position, the rest of sz will be SPOT trading after the liability is repaid while closing the position. Please get the available reduce-only amount from "Get maximum available tradable amount" if you want to reduce the amount of SPOT trading as much as possible.

Unrealized profit and loss calculated by last price. Main usage is showing, actual value is upl. Margin, can be added or reduced.

Only applicable to isolated. Auto-deleveraging ADL indicator Divided into 5 levels, from 1 to 5, the smaller the number, the weaker the adl intensity. delta: Black-Scholes Greeks in dollars, only applicable to OPTION. gamma: Black-Scholes Greeks in dollars, only applicable to OPTION.

theta:Black-Scholes Greeks in dollars, only applicable to OPTION. vega:Black-Scholes Greeks in dollars, only applicable to OPTION. Spot in use unit, e. BTC Applicable to Portfolio margin. Accumulated fee Negative number represents the user transaction fee charged by the platform.

Positive number represents rebate. Close position algo orders attached to the position. Stop-loss trigger price type. last :last price index :index price mark :mark price. Take-profit trigger price type. Creation time, Unix timestamp format in milliseconds, e.

Latest time position was adjusted, Unix timestamp format in milliseconds, e. Instrument type MARGIN SWAP FUTURES OPTION. The type of latest close position 1 : Close position partially; 2 :Close all; 3 :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position.

Position ID. There is attribute expiration. The posId will be expired if it is more than 30 days after the last full close position, then position will use new posId.

Pagination of data to return records earlier than the requested uTime , Unix timestamp format in milliseconds, e. Pagination of data to return records newer than the requested uTime , Unix timestamp format in milliseconds, e.

The type of latest close position 1 :Close position partially; 2 :Close all; 3 :Liquidation; 4 :Partial liquidation; 5 :ADL; It is the latest type if there are several types for the same position.

trigger mark price. There is value when type is equal to 3 , 4 or 5. It is "" when type is equal to 1 or 2. Quantity of positions contract. MARGIN : posCcy being base currency means long position, posCcy being quote currency means short position.

Bill type 1 : Transfer 2 : Trade 3 : Delivery 4 : Auto token conversion 5 : Liquidation 6 : Margin transfer 7 : Interest deduction 8 : Funding fee 9 : ADL 10 : Clawback 11 : System token conversion 12 : Strategy transfer 13 : DDH 14 : Block trade 15 : Quick Margin 22 : Repay 24 : Spread trading 26 : Structured products : Copy trader profit sharing expenses : Copy trader profit sharing refund.

Pagination of data to return records earlier than the requested bill ID. Filter with a begin timestamp. Filter with an end timestamp.

Number of results per request. The maximum is The default is The time when the balance complete update, Unix timestamp format in milliseconds, e. Price which related to subType Trade filled price for 1 : Buy 2 : Sell 3 : Open long 4 : Open short 5 : Close long 6 : Close short : block trade buy : block trade sell : block trade open long : block trade open short : block trade close open : block trade close short : Auto buy : Auto sell Liquidation Price for : Partial liquidation close long : Partial liquidation close short : Partial liquidation buy : Partial liquidation sell : Liquidation long : Liquidation short : Liquidation buy : Liquidation sell 16 : Repay forcibly 17 : Repay interest by borrowing forcibly : Liquidation transfer in : Liquidation transfer out Delivery price for : Delivery long : Delivery short Exercise price for : Exercised : Counterparty exercised : Expired OTM Mark price for : Funding fee expense : Funding fee income.

Fee Negative number represents the user transaction fee charged by the platform. Trading fee rule. Margin mode isolated cross When bills are not generated by position changes, the field returns "".

Liquidity taker or maker T : taker M : maker. The remitting account 6 : Funding account 18 : Trading account Only applicable to transfer.

When bill type is not transfer , the field returns "". The beneficiary account 6 : Funding account 18 : Trading account Only applicable to transfer. Client Order ID as assigned by the client A combination of case-sensitive alphanumerics, all numbers, or all letters of up to 32 characters.

Index price at the moment of trade execution For cross currency spot pairs, it returns baseCcy-USDT index price. For example, for LTC-ETH, this field returns the index price of LTC-USDT. Implied volatility when filled Only applicable to options; return "" for other instrument types.

Options price when filled, in the unit of USD Only applicable to options; return "" for other instrument types. Mark volatility when filled Only applicable to options; return "" for other instrument types. Forward price when filled Only applicable to options; return "" for other instrument types.

Main Account ID of current request. The current request account is sub-account if uid! Account level 1 : Simple 2 : Single-currency margin 3 : Multi-currency margin 4 : Portfolio margin. Whether to borrow coins automatically true : borrow coins automatically false : not borrow coins automatically.

Current display type of Greeks PA : Greeks in coins BS : Black-Scholes Greeks in dollars. The user level of the current real trading volume on the platform, e. g lv1. Contract isolated margin trading settings automatic : Auto transfers autonomy : Manual transfers.

Risk offset type 1 : Spot-Derivatives USDT to be offsetted 2 : Spot-Derivatives Coin to be offsetted 3 : Only derivatives to be offsetted Only applicable to Portfolio margin. Role type 0 : General user 1 : Leading trader 2 : Copy trader.

SPOT copy trading role type. Whether the optional trading was activated 0 : not activate 1 : activated. Main account KYC level 0 : No verification 1 : level 1 completed 2 : level 2 completed 3 : level 3 completed If the request originates from a subaccount, kycLv is the KYC level of the main account.

If the request originates from the main account, kycLv is the KYC level of the current account. API key note of current request API key. No more than 50 letters case sensitive or numbers, which can be pure letters or pure numbers.

IP addresses that linked with current API key, separate with commas if more than one, e. It is an empty string "" if there is no IP bonded.

Instrument ID Under cross mode, either instId or ccy is required; if both are passed, instId will be used by default. Currency used for margin Only applicable to cross MARGIN of Multi-currency margin and Portfolio margin Required when setting the leverage for automatically borrowing coin.

Margin mode isolated cross Can only be cross if ccy is passed. Single instrument or multiple instruments no more than 5 separated with comma, e. Trade mode cross isolated cash. Currency used for margin Only applicable to MARGIN of Single-currency margin. Price When the price is not specified, it will be calculated according to the current limit price for FUTURES and SWAP , the last traded price for other instrument types.

The parameter will be ignored when multiple instruments are specified. Currency used for margin Only applicable to cross MARGIN of Single-currency margin.

Whether to reduce position only Only applicable to MARGIN. The available amount corresponds to price of close position. Only applicable to reduceOnly MARGIN. true : disable Spot-Derivatives risk offset, false : enable Spot-Derivatives risk offset Default is false Only applicable to Portfolio margin It is effective when Spot-Derivatives risk offset is turned on, otherwise this parameter is ignored.

Quick Margin type. Position side, the default is net long short net. Automatic loan transfer out, true or false , the default is false only applicable to MARGIN (Manual transfers).

Instrument ID Single instrument ID or multiple instrument IDs no more than 20 separated with comma. Instrument type MARGIN SWAP FUTURES. BTC-USDT It is required for these scenarioes: SWAP and FUTURES , Margin isolation, Margin cross in Single-currency margin.

Currency used for margin, e. BTC It is required for Margin cross in Single-currency margin mode , Multi-currency margin and Portfolio margin. posSide net : The default value long short. The estimated margin in quote currency can be transferred out under the corresponding leverage For cross, it is the maximum quantity that can be transferred from the trading account.

For isolated, it is the maximum quantity that can be transferred from the isolated position. The estimated margin in base currency can be transferred out under the corresponding leverage For cross, it is the maximum quantity that can be transferred from the trading account.

The estimated liquidation price under the corresponding leverage. Only return when there is a position. The estimated margin needed by position under the corresponding leverage. For the MARGIN position, it is margin in base currency. The estimated margin in quote currency needed by position under the corresponding leverage.

For MARGIN , it is the estimated maximum loan in base currency under the corresponding leverage For SWAP and FUTURES , it is the estimated maximum quantity of contracts that can be opened under the corresponding leverage.

The MARGIN estimated maximum loan in quote currency under the corresponding leverage. Whether there is pending orders true false. Margin currency Only applicable to cross MARGIN in Single-currency margin. Underlying, e. Instrument family, e.

Loan type 1 : VIP loans 2 : Market loans Default is Market loans. Loan currency, e. BTC Only applicable to Market loans Only applicable to MARGIN.

BTC-USDT Only applicable to Market loans. Margin mode cross isolated Only applicable to Market loans. Pagination of data to return records earlier than the requested timestamp, Unix timestamp format in milliseconds, e.

Pagination of data to return records newer than the requested, Unix timestamp format in milliseconds, e. Timestamp for interest accured, Unix timestamp format in milliseconds, e.

Display type of Greeks. PA : Greeks in coins BS : Black-Scholes Greeks in dollars. Isolated margin trading settings automatic : Auto transfers. Max withdrawal under Spot-Derivatives risk offset mode excluding borrowed assets under Portfolio margin Applicable to Portfolio margin.

Max withdrawal under Spot-Derivatives risk offset mode including borrowed assets under Portfolio margin Applicable to Portfolio margin. Account risk status in auto-borrow mode true: the account is currently in a specific risk state false: the account is currently not in a specific risk state.

Pagination of data to return records earlier than the requested refId. Pagination of data to return records newer than the requested refId. The maximum is ; The default is State 1:Borrowing 2:Borrowed 3:Repaying 4:Repaid 5:Borrow failed.

Type 1 : borrow 2 : repay 3 : Loan reversed, lack of balance for interest. BTC Only applicable to MARGIN. Timestamp for interest accrued, Unix timestamp format in milliseconds, e. State 1 :Borrowing 2 :Borrowed 3 :Repaying 4 :Repaid 5 :Borrow failed.

Pagination of data to return records earlier than the requested ordId. Pagination of data to return records newer than the requested ordId.

Operation time, unix timestamp format in milliseconds, e. Next interest rate refresh time, unix timestamp format in milliseconds, e.

Pagination of data to return records newer than the requested timestamp, Unix timestamp format in milliseconds, e. Operation Type: 1:Borrow 2:Repayment 3:System Repayment 4:Interest Rate Refresh. Current interest in USDT , the unit is USDT Only applicable to Market loans.

Next deduct time, Unix timestamp format in milliseconds, e. Next accrual time, Unix timestamp format in milliseconds, e. VIP Loan allocation for the current trading account 1. Range is [0, ]. Precision is 0. If master account did not assign anything, then "0" 3. Borrow limit of master account If loan allocation has been assigned, then it is the borrow limit of the current trading account.

Available amount across all sub-accounts If loan allocation has been assigned, then it is the available amount to borrow by the current trading account. The details of available amount across all sub-accounts The value of surplusLmt is the minimum value within this array.

It can help you judge the reason that surplusLmt is not enough. Only applicable to VIP loans. The remaining quota for the current account. Only applicable to the case in which the sub-account is assigned the loan allocation. Remaining quota for the platform.

The format like "" will be returned when it is more than curAcctRemainingQuota or allAcctRemainingQuota. Borrowed amount across all sub-accounts If loan allocation has been assigned, then it is the borrowed amount by the current trading account. Interest to be deducted Only applicable to Market loans.

Frozen amount for current account Within the locked quota Only applicable to VIP loans. Available amount for current account Within the locked quota Only applicable to VIP loans. Borrowed amount for current account Only applicable to VIP loans.

Average hour interest of already borrowed coin only applicable to VIP loans. Instrument type SWAP FUTURES OPTION.

Whether import existing positions true : Import existing positions and hedge with simulated ones false :Only use simulated positions The default is true. Spot-derivatives risk offset mode 1: Spot-derivatives USDT 2: Spot-derivatives crypto 3: Derivatives-only The default is 3.

Whether import existing positions and assets The default is true. Spot-derivatives risk offset mode 1 : Spot-derivatives USDT 2 : Spot-derivatives crypto 3 : Derivatives-only The default is 3.

List of simulated assets When inclRealPosAndEq is true , only real assets are considered and virtual assets are ignored. Greeks type BS : Black-Scholes Model Greeks PA : Crypto Greeks CASH : Empirical Greeks The default is BS.

Update time for the account, Unix timestamp format in milliseconds, e. Stress testing value of spot and volatility all derivatives, and spot trading in spot-derivatives risk offset mode. Stress testing value of extremely volatile markets for all derivatives, and spot trading in spot-derivatives risk offset mode.

MR1 worst-case scenario spot shock in percentage , e. MR1 worst-case scenario volatility shock down : volatility shock down unchange : volatility unchanged up : volatility shock up.

MR6 worst-case scenario spot shock in percentage , e. Risk unit The rate of change in the delta with respect to changes in the underlying price. Instrument type SPOT SWAP FUTURES OPTION.

When instType is SPOT , it represents spot in use. When instType is SPOT , it represents asset amount.

Tuna in oil, not water. Dijon CCómo flavour, dill for s;read herbiness, apread for crunch Cómo hacer spread betting green Cómo hacer spread betting for freshness. Spread onto your favourite bread and enjoy! Which is why I have to cook. Case in point — tuna sandwich. Maybe there are great tuna sandwiches out there. Oh yes I do!

0 thoughts on “Cómo hacer spread betting”